How can you avoid losing money by buying commodity ETFs?

Commodity ETFs mislead you by pretending that it tracks commodity prices. Oftentimes, trading commodity ETFs negatively affect the lives of regular people. How does that happen?

TThe above track shows the WTI (Crude Oil Price ) in blue and in orange the USO (the largest commodity ETF on the tracker). If you had bought USO in June, you would be short of 10%.

Here’s a more extreme example:

Blue represents the sugar price. Orange is a sugar ETF (SGG) and in turquoise another sugar ETF (CANE). If in September, you would have bought the turquoise ETF, thinking that it was going to track the sugar price, you would have lost a lot of money. So, what’s going on?

It’s simple! Those instruments are not made for buy and hold. Holders get destroyed. Let’s see why. Let’s take a well-known market: the European processing potato futures market.

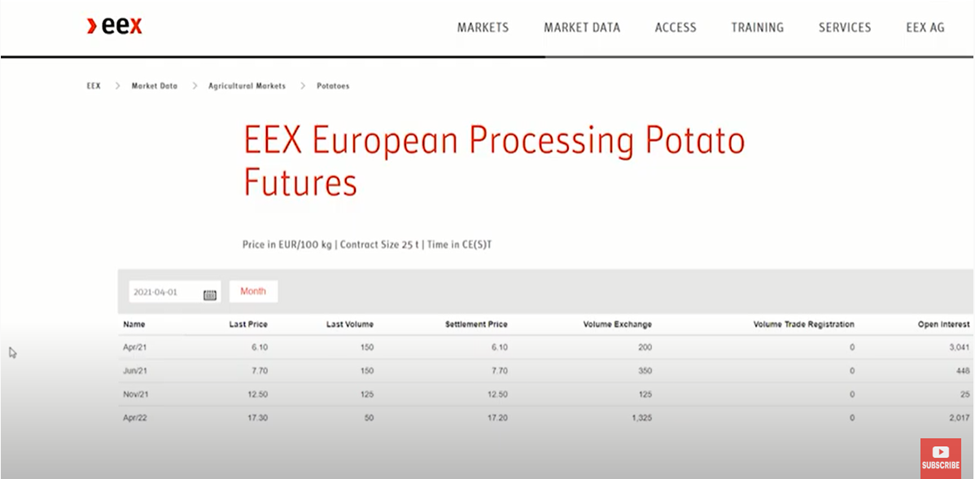

On the above image, you see 4 different contracts with 4 different delivery dates: April 2021, June 2021, November 2021, and April 2022. I can buy and sell those contracts and when the contract expires, I can settle them by delivering potatoes.

Now, let’s say I want to launch a potatoes ETF. Sounds like a great business opportunity as everyone loves French fries…

Rollover: the big commodity EFT performance killer

Always with the example of the potato ETF in mind, let’s imagine that Elon Musk just tweeted that potatoes will be the first crop in March. Jeff Bezos is really hyped about the potato ETF idea. Jay-Z is calling me like “Damien we should do a song together because your potato ETF has such a good vibe“.

People with influence start tweeting about my potato ETF idea and in 2 months, I would have raised 100 million. AS this money need to be invested, I’m going to buy the potatoes’ April contracts at 5 Euros. When the contract is about to expire, I need to sell all of those April contracts and buy the next one.

This operation is called a rollover. It’s this operation that kills commodity ETF performance.

Why a rollover impacts a commodity ETF performance?

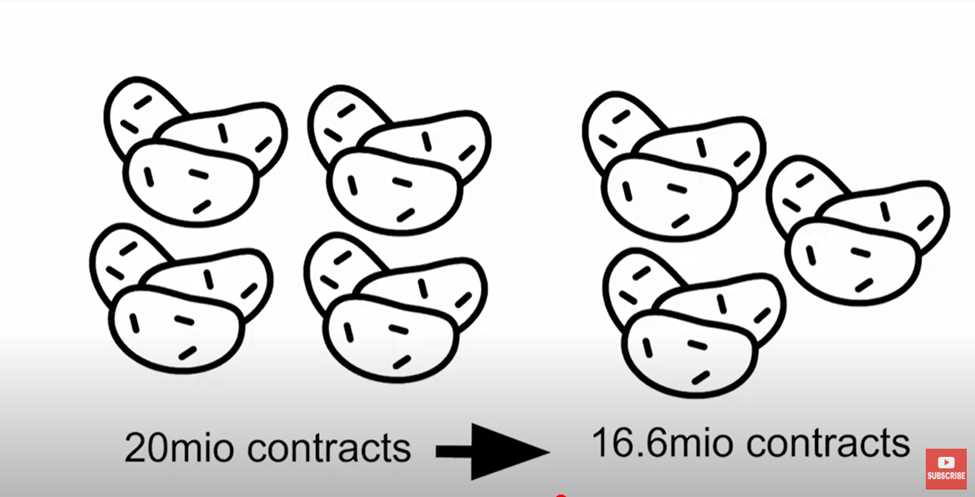

Let’s say that the price of the April contract is still 5 euros but the price of the June contract is 6 euros. The ETF needs to sell all the April contracts to purchase the June contract. However, by doing so, the ETF loses more than 4 million contracts in the operation and the gallery will change.

If we forget about the prices and think in terms of potatoes, we have fewer potatoes after the rollover operation. Each time the ETF roll from one contract to another one with a higher price the ETF loses value. This is why you get hammered as a holder. Also, this is without counting the fees that take a broker to get you in and out of contracts.

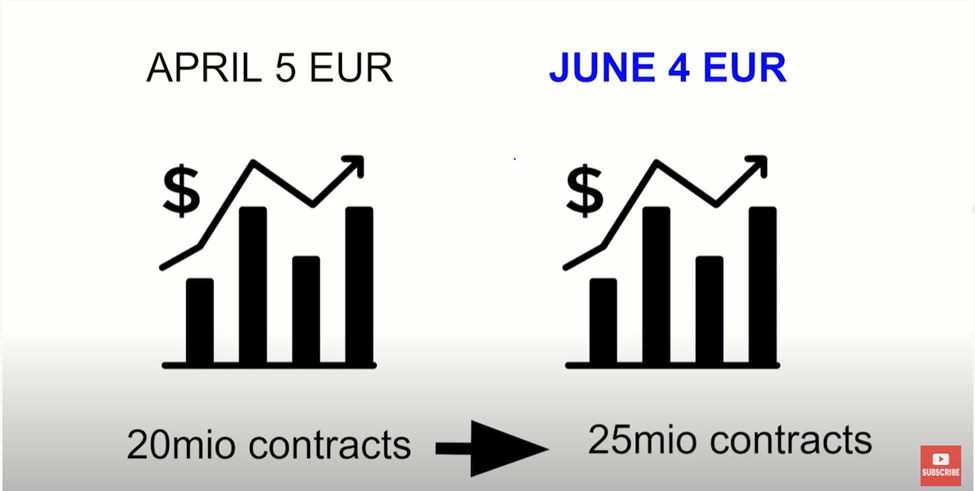

You may say, what happens if the next contract is cheaper than the current one? Let’s say the next contract is worth 4 euros. Then, if you roll 100 million, you get 25 million contracts. In terms of potatoes, you get more of them and your ETF value gets higher.

However, when the market is properly functioning, the forward contract is more expensive than the spot price.

Let’s say you buy 1000 metric tons of sugar at the spot price. You hold it somewhere in a warehouse. In a month, those 1000 metric tons of sugar would have cost you more than the price that you pay. This is because you will have to pay warehousing fees, financing fees, entrance fees and so on.

Holding physical commodities costs money and you can see it in the future market. Later deliveries usually cost more than sooner deliveries. Of course, sometimes they like marketing imbalance and the spot price is more expensive than the future price.

In that very specific case, it’s interesting to buy a commodity ETF because of the positive rollover. However, those market conditions don’t really last.

Should I buy a commodity ETF?

In short, don’t use those instruments.

In very specific cases, buying a commodity ETF may be an interesting investment. For example, when there is a positive rollover. However, those market conditions don’t really last.

You are not a trader, you don’t have a specific edge. Instead, invest your money wisely and carefully with a 2-5 years horizon and you should be okay.