I’m a physical commodity trader. I buy, sell, hedge, stock, blend, ship, commodities around the world. I work on a daily basis with companies based in Europe, Africa, Asia and Oceania. Through my job, I have direct exposure to numerous pain points that cryptocurrencies and blockchain protocols will/could solve. I will review in this blog post trough my commodity trader lens the 3 following points:

-

International payment

-

Market volatility

-

Less economically developed countries

If I want to send 30’000 USD from Germany to an African counter party. It would take 3 to 4 days to have the amount credited on the African bank account AND it will cost around 400USD! It’s a steal! The SWIFT protocol on which the international banking system is built is slow, expensive and prompt to mistake!

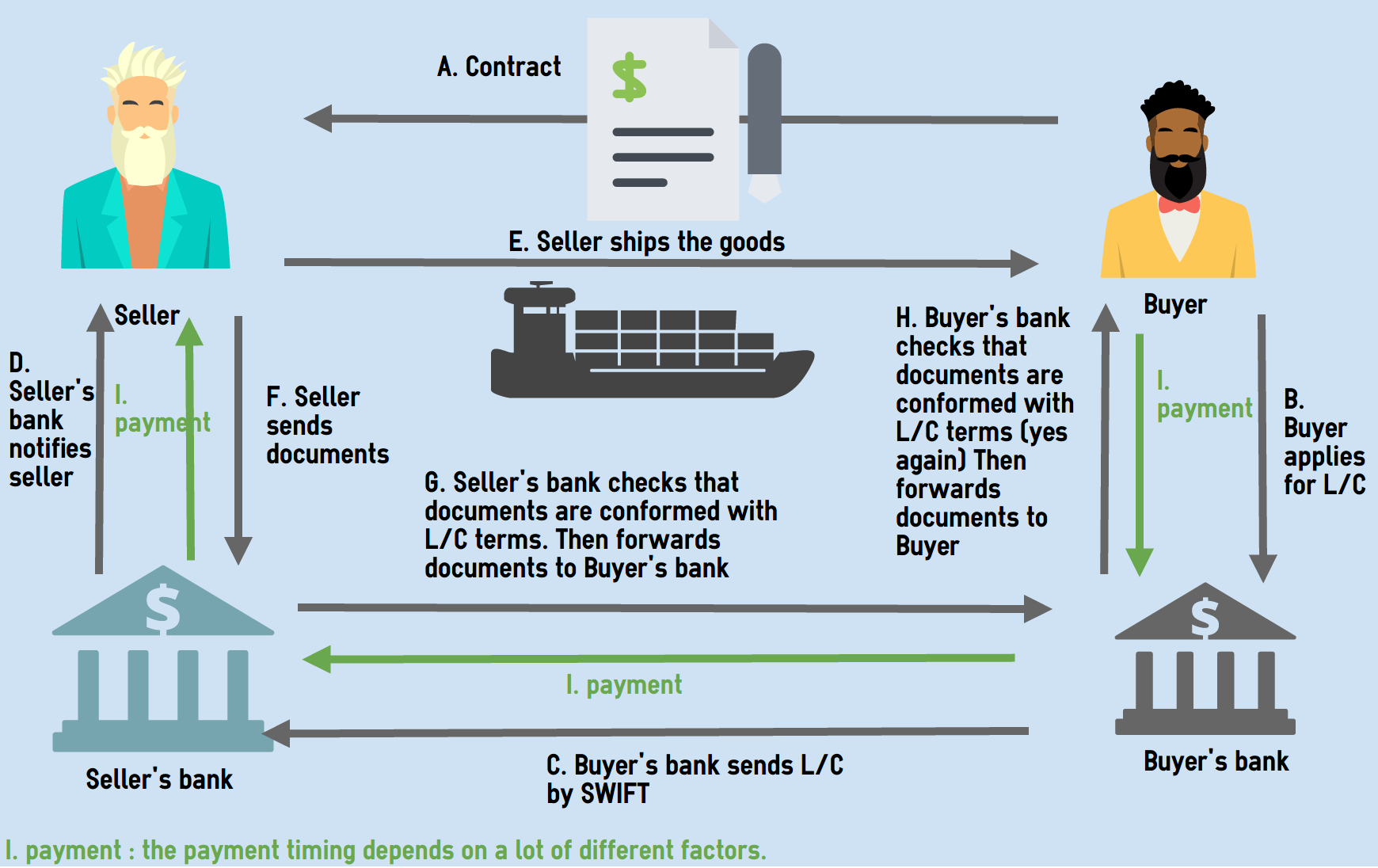

In the case of shipment (by container or break bulk), where the amount varies between couple thousand USD to millions, the most common payment method used is called “Letter of Credit” (L/C). L/C are currently the safest way to do business with a less known entities from another country. Basically, what happened is your bank taking the risk of non-payment off the seller’s hand, if the seller fulfills the obligation state in the L/C. For instance, the obligations could be, time of shipment of the good, certificate to issue, inspection done by specific third parties, etc…

It’s not only highly expensive (as you can imagine the banks take theirs fees), it’s also time-consuming, resource-consuming AND there is 100000 ways to get “*ç%* and lifting the obligation from your bank to pay you…

Here is a short and simplify of how L/C works.

- Seller (S) wants to sell 15’000mt of rice to a Buyer(B).

- As you don’t know well the buyer you ask him to open a L/C for the value of the shipment.

- B goes to his bank, ask to open an L/C (OB for Opening Bank)

- S nominate his bank to receive the L/C (SB for Seller Bank)

- Once the rice is shipped on the vessel, S sends the sets of documents stated in the L/C to the SB.

- SB reviews the documents, accepts them as compliant with the L/C

- SB send the documents to OB

- OB reviews the documents, accepts them as compliant with the L/C

- OB sends the documents to B.

Here is a diagram another way to explained the L/C principles :

Have you followed??? Bravo! Ok now just few ways to show you how horrible is this way of doing business.

- Time: each bank must review the documents… imagine if your shipment takes only 3 days to arrive at destination…

- L/C wording: if there are any words wrongly written in the set of documents remitted to the bank. This will be treated as a discrepancy and will lift the obligation from your bank to pay you… So the bank which you pay for the guarantee of payment is incentive to find mistake in your documents in order to relieve it from it obligation

- Manpower: You need someone in house reviewing and issuing each document to be perfectly in accord with L/C terms. Something you need 13 documents issued by different parties and you must make sure that the wording stays exactly the same as per the L/C requirement.

- Banks are not willing to work with any other banks! If your client is located in a small country with no large international banks. It may almost be impossible to find another bank willing to work with them… OR you need to add a 3rd bank between OB and SB to bridge the trust. And don’t forget ! each bank takes a fees.

I can go on, for hours like on how stupide this method is.

But here comes the light! the block chain and smart contracts!

The blockchain/smart contract has the ability to complete solve the trust issue that L/Cs were supposed to solve. We can easily imagine smart contracts with the following logics :

- Seller has to comply with Y,Z

- Inspection company has to do X

- Then when shipping company scan the containers at the arrival payment is executed.

I’m not saying this will arrive within 5 years, but I’m sure we will come to this point. There are no reason to continue with this flawed system.

You are a one of the biggest coal buyer in China. You have concluded a delivery in 8 months with a small Singaporean trader from an Australian mine. As you think that the market will increase, and you want to cover your needs. Bad luck, you are complete wrong, the market is divided by 2. You can buy the exact same coal for 300’000USD the cargo instead of 600’000USD. Furthermore, your company is not in a good financial shape, and 300’000USD would really help you. What do you do? Are you really going to honor your contract and take the shipment? You are in China, you know for the Singaporean it’s going to be almost impossible to take any legal action against you. What do you do ?

Where do I want to go with that ? I’m just saying that the people with the right leverages will not accept (or be able) to take their losses and there will be collateral damages. In the current crypto world, there are a lot of games of powers amplifies by the crazy market volatility. The volatility reduces the market adoptions by the more conservative people and push to speculation and bad behaviors.

At a certain point, we will need to cryptocurrencies markets to calm the f*** down to have a broader and healthier adoption.

- Computer education: The new middle class all use smartphone, but I noticed that their educations in term of how to use a computer is small. Using a simple office suite, it’s not as common as we could think.

- General education: The level of extrapolation you need to attain to understand the concept of cryptocurrency is already quite challenging for the people with a high education. So, imagine when you have none… Cryptocurrency must be easy to use and already quite advanced in their general adoption to have a mind-switch and start to use the currency as it is without having the need to understand what’s behind it.

- Currency control: This is the biggest hurtle. Of course, the government will do everything in their power to avoid a general acceptance of cryptocurrency. But don’t forget that most of the less developed countries have currency control. Meaning you must show a proof and provide an explanation when you want to exchange your local currency in USD or EUR. Therefore, how can you send your money to a broker ? As far as I know there are no brokers accepting Guinean franc or Algerian dinar.

- Cash is king : Yes… most of the transaction are cash-based. Believe me, I saw backpack full of cash to pay a container of sugar or rice…! And people have no bank account. I met few rich people who rather have a safe hidden than a bank account.