For the last year or so, I’ve been heavily involved with all kinds of small-scale commodity producers ( by small scale, I mean roughly less than 250’000 USD net profit per year)

To give you an idea, I dabble with two dozen commodities or commodity-like producers, such as manganese, cocoa, water, rare earth, avocado, solar energy, etc…

Here are my observations

They fail to understand the ruthless commodity game they are in.

Commodity producers produce fungible goods. Anyone can extremely easily interchange one product to another.

Therefore a buyer doesn’t need to “try” a new product origin. If he already has a handful of serious suppliers with whom he’s been doing business for years. Why on earth would he switch?

Basically, they are not ready to produce the effort to grab international buyers’ attention.

They fail to understand what it means to take outside capital.

“No, I’m not giving you money to buy machinery, without you opening your books.”

“No, I’m not wiring you money and hope that next season, you’ll hand something to me.”

What most of them want is free money with almost no string attached. When you accept outside capital, you are not the only captain on the boat.

They don’t want to be held accountable.

Before any investment deal, I think it’s always important to gauge how committed to his words an operator/owner is. It may seem obvious, but different cultures have different ways to deal with commitment.

For an instant, I always end a conversation with a call to action and an exact deadline:”

- Ok, so when you’ll be able to send XYZ documents?”

- By Thursday

- Are you sure? Because if you tell me Thursday, I’ll see it as a red flag if you don’t deliver it on Thursday. Whatever are the excuses

- Ok, so let’s say Monday as I’ll be able to work on it during the weekend. “

Another point is that throughout the negotiation and due diligence, I always keep my counterparty accountable for the numbers they throw out:

– Last month, you said that your production would be X, but now you tell me that the production is Y? What has happened? “

They need to understand they have to be 100% transparent AND accountable with thier partners.

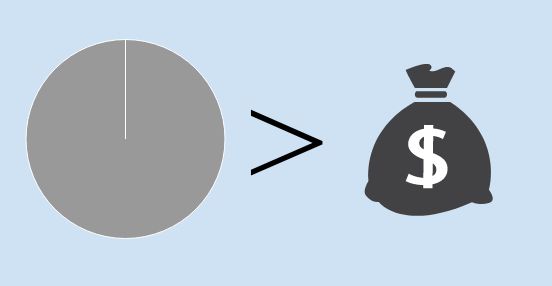

They value ownership above profit.

Let me explains…

Let’s say that a small mine is poorly equipped with a rich terrain, and thier operation only net 100’000 USD per year.

Let’s say that with 500’000 USD of outside capital, you can purchase enough equipment to triple your profit, bringing your net to more than 300’000 USD per year. Also, the overall trend for the underlying commodity is bullish, and higher prices are expected.

In that above scenario, how much of your company would be ready to sell for those 500’000 USD?

Please let me have your comments below.

I’m genuinely interested in your answers. 😊

Anyway, I hope you don’t find me to harsh on those small producers! But usually, if they stay small half a decade, there is often a good reason for that.