Molybdenum is a critical metal used in various industries, from steel production to electronics. For those interested in trading molybdenum, understanding market trends, pricing dynamics, and the key factors influencing supply and demand is essential. This knowledge not only aids in making informed decisions but also enhances the potential for successful trades.

Investors can trade molybdenum through various methods, including physical purchases, futures contracts, or investing in mining companies. Each approach carries its own risks and benefits, so it’s vital to research and choose a strategy that aligns with individual investment goals.

As interest in sustainable technologies grows, molybdenum’s importance continues to rise, creating new opportunities for traders. By staying updated on market developments and utilizing effective trading strategies, traders can capitalize on fluctuations and make strategic investments.

Understanding Molybdenum Trading

Molybdenum trading requires knowledge of its fundamentals, market role, and the dynamics of supply and demand. Gaining a clear understanding of these aspects helps traders make informed decisions.

The Fundamentals of Molybdenum

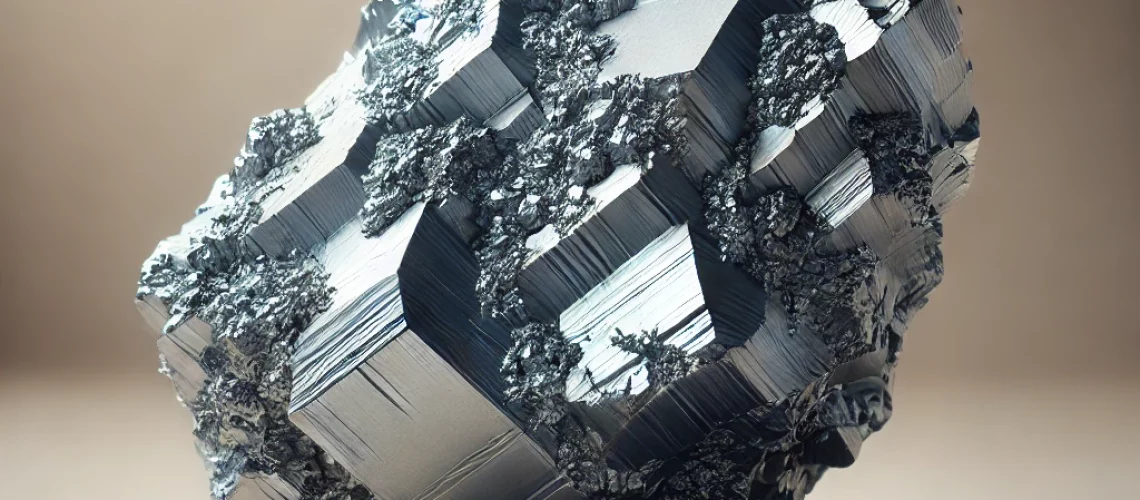

Molybdenum is a metallic element primarily used in steel production, enhancing strength and resistance to corrosion. It is often found in high-performance alloys. The metal’s properties, such as high melting point, make it valuable in industries like aerospace and nuclear energy.

Molybdenum is available in various forms, including molybdenum concentrate and molybdenum oxide. Investors often trade futures and options reflecting molybdenum prices on commodity exchanges. Understanding its chemical composition and application is crucial for traders, as these factors influence market demand and pricing.

Molybdenum’s Role in the Market

Molybdenum plays a critical role in both industrial applications and investment portfolios. It acts as a crucial component in producing specialized steels and metal alloys, supporting sectors like construction and transportation.

As a commodity, molybdenum’s price is influenced by global economic conditions, particularly in major consuming countries, such as China and the United States. Strategic decisions by mining companies and geopolitical factors can also affect its availability and pricing.

Supply and Demand Dynamics

The supply of molybdenum is often concentrated in a few countries, notably Chile, the United States, and Peru. Changes in mining regulations, environmental policies, or production capacities can significantly impact supply levels.

On the demand side, growth in the automotive and construction sectors typically increases molybdenum consumption. Market fluctuations in steel production or technological advancements can shift demand patterns, making it essential for traders to monitor these trends closely.

Understanding these dynamics is vital for making well-informed trading decisions in the molybdenum market.

Strategies for Molybdenum Trading

Effective trading strategies for molybdenum focus on understanding market trends, assessing supply and demand dynamics, and implementing sound risk management. Traders can enhance their performance by leveraging technical and fundamental analysis.

Technical Analysis

Technical analysis involves studying historical price charts and market data to predict future price movements. Traders often use various tools, such as moving averages, to identify trends. Key indicators include the Relative Strength Index (RSI) and Bollinger Bands.

Support and resistance levels play a crucial role in determining entry and exit points. Traders can use these levels to set stop-loss orders effectively. Volume analysis also helps assess the strength of price movements. A high volume during a price rise may indicate strong buyer interest.

Fundamental Analysis

Fundamental analysis examines external factors that impact molybdenum prices. Key elements include global supply and demand, geopolitical events, and economic indicators. For instance, significant disruptions in major producer countries can lead to price volatility.

Monitoring production levels and technological advancements in mining can provide insights into future supply. Additionally, reviewing industry reports and forecasts helps traders understand potential market shifts. Economic health indicators, such as GDP growth rates, can influence demand since molybdenum is essential in various industries, including steel production.

Risk Management Techniques

Risk management is essential for successful trading. Setting a clear risk-reward ratio ensures that potential losses are minimized. Traders often use stop-loss orders to protect against significant losses. Maintaining a diversified portfolio can also reduce overall risk exposure.

Position sizing is another critical aspect. It involves determining how much to invest in each trade based on account size and risk tolerance. Traders should regularly monitor their trades and adapt strategies based on changing market conditions. This proactive approach can help prevent emotional decision-making during market fluctuations.

Regulatory Environment

Navigating the regulatory landscape is essential for successful molybdenum trading. Key aspects include understanding regulations governing trading and knowing compliance and reporting requirements.

Understanding Regulations

The trading of molybdenum is subject to various national and international regulations. These regulations are primarily established to ensure fair trading practices and market stability.

Countries often have specific rules regarding the extraction, processing, and marketing of molybdenum. Regulatory bodies may include the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in the United States, or similar bodies in other nations.

Additionally, international agreements can affect trading practices. For example, trade policies may impose tariffs or quotas on molybdenum exports. Traders must remain aware of changes to these regulations to avoid penalties or legal issues.

Compliance and Reporting Requirements

Compliance with regulations is critical for those trading molybdenum. Traders must maintain accurate records of transactions and report them to relevant authorities.

Key reporting requirements may include:

- Transaction reporting: Submitting detailed reports on trades executed.

- Financial disclosures: Providing financial statements that may affect trading capabilities.

- Environmental compliance: Adhering to laws regarding the environmental impact of molybdenum sourcing.

Failure to comply with these requirements can result in significant fines or legal repercussions. As such, traders often implement compliance programs to ensure they meet all regulatory obligations. Regular audits and staff training are common practices to support adherence to regulations.

Challenges and Considerations

Trading molybdenum presents several challenges that traders must navigate. The complexities of market dynamics and liquidity can significantly impact trading strategies.

Market Volatility

Molybdenum prices can experience significant fluctuations due to various factors. Changes in global demand, particularly from industries such as steel and aerospace, can lead to sharp price movements.

Economic events, geopolitical tensions, and shifts in mining output also contribute to volatility. Traders need to be prepared for rapid price changes, necessitating a solid risk management strategy.

To manage risk effectively, traders often use tools such as stop-loss orders and diversifying their portfolios. Understanding historical price trends can also provide insights into potential future movements.

Liquidity Issues

Liquidity is another critical consideration when trading molybdenum. The market for molybdenum can be less liquid compared to more widely traded metals. This can lead to challenges in executing trades at desired prices.

Low liquidity often results in wider bid-ask spreads, which increases trading costs. Traders may experience difficulties entering or exiting positions swiftly, especially during market volatility.

To mitigate liquidity issues, participants may focus on established trading venues or engage in hedging strategies. Additionally, monitoring trading volumes can help gauge market activity and potential liquidity.

Future of Molybdenum Trading

Molybdenum trading is likely to be influenced by technological advancements and geopolitical changes. These factors can reshape supply chains, pricing strategies, and demand in various industries.

Technological Advancements

Innovations in extraction and processing technologies are poised to enhance molybdenum production efficiency. Improvements like hydro-metallurgical processes can reduce waste and lower production costs.

Automation and data analytics will also play significant roles. Companies can optimize operations through better demand forecasting and real-time monitoring of supply chains.

Sustainable mining practices are gaining traction as well. Adopting greener methods can attract investors and consumers who prioritize environmental responsibility. This shift may lead to increased demand for responsibly sourced molybdenum.

Geopolitical Impacts

Geopolitical tensions and trade agreements will affect molybdenum supply and pricing. Countries that produce molybdenum, such as Canada, Chile, and the United States, may experience fluctuations based on international relations.

Tariffs and trade policies can directly impact market prices. For instance, sanctions on key producing countries can disrupt supply chains, leading to rapid price increases.

Additionally, shifts in global demand from industries such as construction and automotive may alter trade dynamics. Monitoring these changes is crucial for investors and traders to make informed decisions in a changing market landscape.