How do trading companies make money?

In short, they buy, stock, transport, process and sell commodities from a place of surplus to a place of deficits. The big trading players such as Vitol, Cargill, Trafigura, Olam, Mercuria, Louis Dreyfus, Glencore, etc… always pivot their business model around those activities.

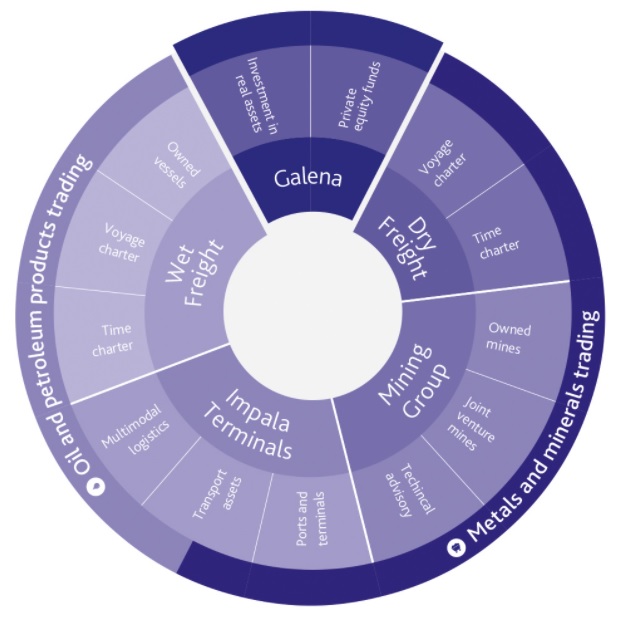

Let’s take a look at Trafigura’s structure

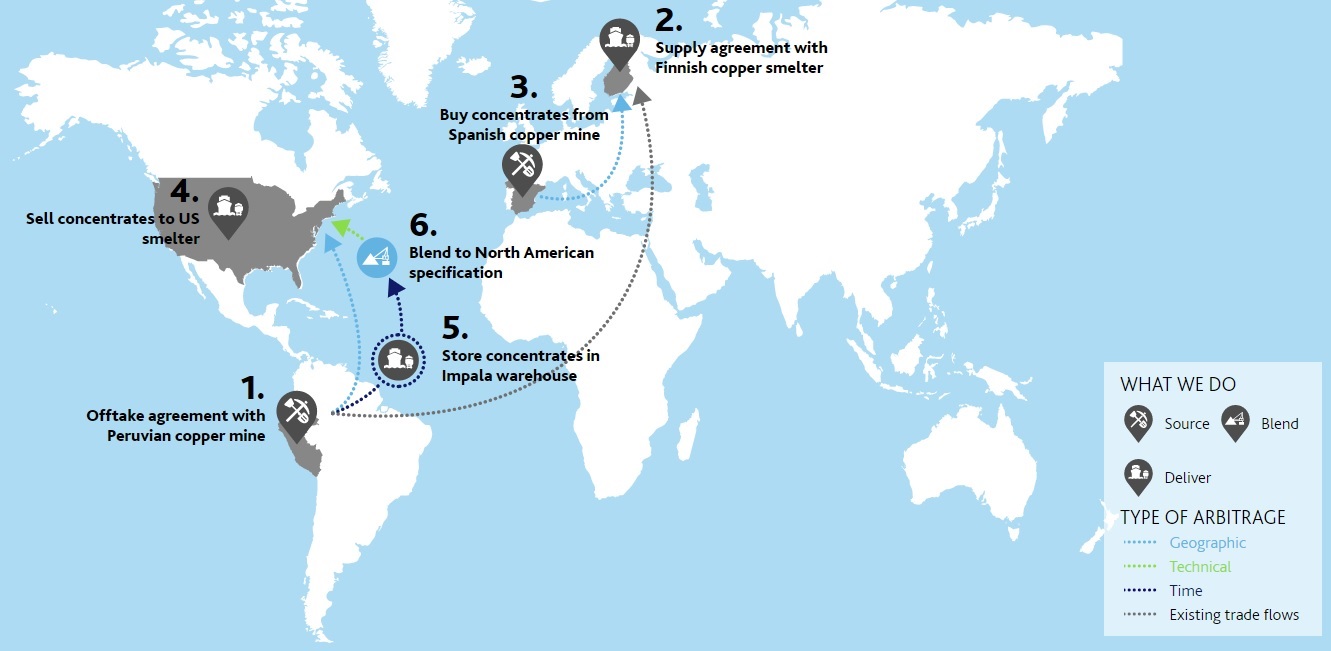

Geographic Arbitrage: Each market has different supply & demand relation. Therefore discrepancies happen when a product is undervalued in an area compared to another one. Two commodities at 10 km of distance could be priced differently…! Traders with a healthy network and a deep knowledge of each area could exploit the price difference to their advantage. Information is capital to make your move before the others market participants see the opportunity.

Below another image drawn from Trafigura’s showing the different type of arbitrage, here they call “technical arbitrage” what I name “quality arbitrage”.

Speculation: Yes! Speculation…! I’ve said it! Even if, trading firms want to avoid this subject, traders may take positions on the market when they perceive a trend in the price. It’s hard to give an estimation of their “position taking” in comparison to normal trading activities, as for simple offtake agreement a market risk could be present. The 80/20 rule seems to work quite well in that case. I think I'm not too far from the reality if I say that 20% of the trading companies speculate 80% of the time. The other way around is also correct: 80% of the trading firms speculate for 20% of their books.

On that note, I want to draw your attention that almost all the hedge fund opened by commodity houses closed after a couple of bad years or low returns, Edesia ex LDC, Black River ex Cargill, etc…

Trade Execution: How to move cost efficiently a commodity from on point in the world to another is much harder than it appears to! This know-how is precious and encompasses a deep understanding of opportunity cost, freight market, storage and light processing. Executing physical contracts on time and minimizing the operational error could be the difference between a profitable and a losing trade.

Here a little true story: A trading company active in a niche market had the “excellent” idea to lay-off all their people in charge of the international shipment based in Geneva and gather the logistics activities in Holland where a desk was already in charge of the intra-EU transports. This restructuration happened a year after a new Dutch CEO was appointed, not a former trader, but an accounting/financial guy. For him, the closing of the desk made a lot of sense as the costs in Switzerland are two times higher than in The Netherlands. Turned-out, in 6 months they lost in logistical “error” 10 times what they had forecasted in saving... Without counting new contracts lost because suppliers/clients would not deal with them again.

Relationship: Traders need to build trust and likability in order to differentiate themselves from the competition. We are in the commodity business. There is virtually no difference between each supplier. Let’s imagine you are in charge of the purchase of a vessel of grain each month. You have 2 suppliers with the exact same price. Which one are you going to choose ..? In some parts of the world, you need years of approach before being able to close a deal.

Traders who have an exceptional knowledge of their counterparties products (Quality) and one personal basis ( Relationship), know the different markets ( Geographic), have a view of the market (Time) and execute reliably one the physical side (Logistics) would protect their market and profit from higher margin without the need to take position (Speculation).

Therefore, we see a division in the trading world. On one side, we have the largest company using their assets and informational advantages to lock margins. On the other side, we have boutique trading companies focusing on niche products/markets where they can outpace the competition by having a way better knowledge than everyone else.