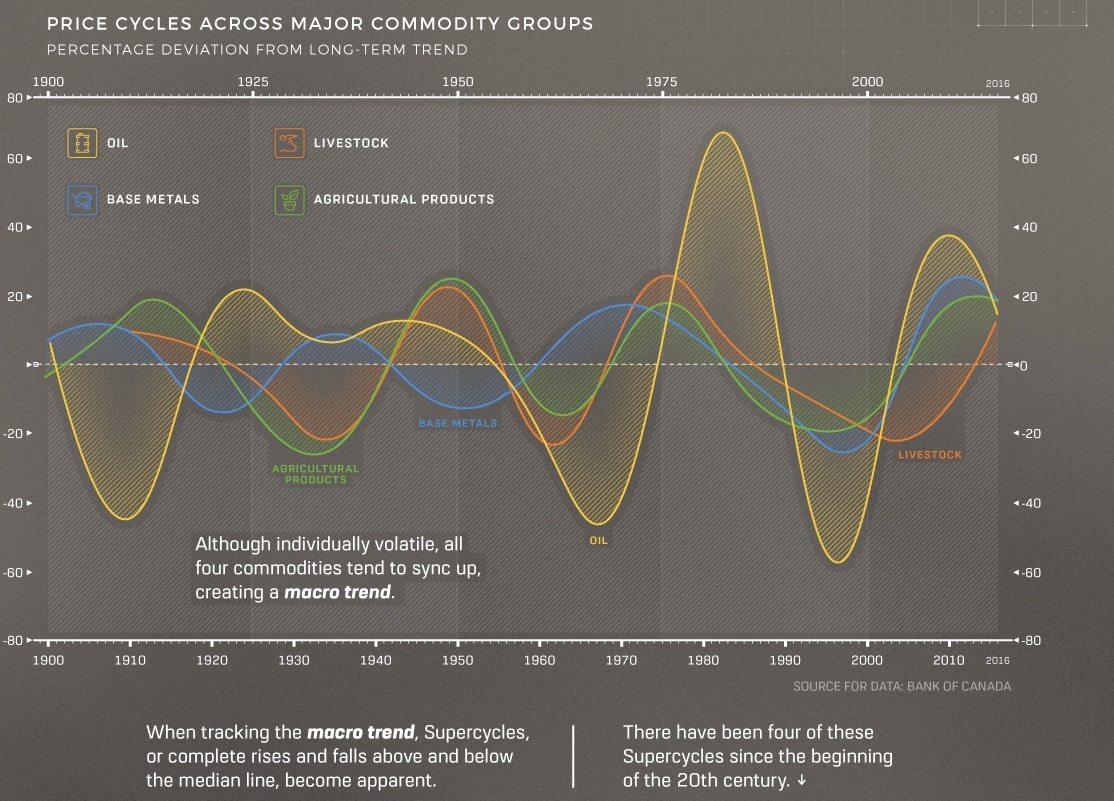

Commodity prices tend to go through extended periods of boom and bust, known as supercycles.

A supercycle is characterized by a prolonged period of rising commodity prices, supported by population growth and infrastructure expansion.

As you can see from the below chart, we have decades between each peak.

Understand how the commodity cycle works

I) The wake-up

At the initial stage of the commodity cycle, there is a surge in demand for commodity-related input. This increase in demand outstrips supply and results in a situation known as excess demand. It’s difficult to spot an excess demand that early in the cycle. Often the commodity price has been depressed for years, and suppliers have been shutting down or operating at a loss.

As I’m writing this article (June 2020), I’m starting to see uranium waking up. Is it the beginning of a strong bull run? A bunch of uranium producers has been wiped out during the last 15 years of the bear market. Furthermore, a couple of producers have used the excuse of COVID19 to close down production sites…

II) The raise

With time, prices will begin to rise, and companies will get easier access to capital to increase their production capacity. The higher demand will spur the increase in production, and prices will continue to increase even further. (June 2020) From my point of view, gold still has a decade long bull-run to go. I would put gold in the rising stage.

III) The bust

As producers increase their investment expenditure and capacity, the supply of commodities to the market increases. Furthermore, the capital to jump-start new production capacity becomes so easy to raise that anyone with a spreadsheet and good storytelling could raise millions.

The switch from the rise to the bust stage occurs when the incoming new production capacity in the pipeline starts to dwarf the current production in place. At this moment, you also begin to see record-high asset purchasing. This is when smart investors get out…

As of today (June 2020), I could not find a commodity that is in the bust stage. If Palladium recovers and reaches new highs before the end of 2020, I would categorize it in the bust stage. We’ll see…

IV) The fall

In the final phase of the commodity cycle, the market experiences an excess supply of commodities. The high prices have incentivized consumers to look for alternatives while a new massive supply stream arrives online. Consequently, prices begin to fall, and producers start to reduce spending. Production capacities are shutting down, and only the best ones manage to get financed.

This stage is the longest, and depending on the commodities could take decades to recover.

Now what?

Once you’ve understood that commodities have long-lasting cycles, it’s time to act on it.

As a young professional, always try to find a job in a depressed commodity. I know it may sound wired. But as the market recovers, you’ll be enjoying a long-lasting bull market and becoming a specialist in a field where there is currently less competition.

As an investor, even tho it’s possible to make money on every stage. Please don’t fall for the hype; for example, my current portfolio consists of gold mining stocks and a couple of bets on uranium. That’s it.